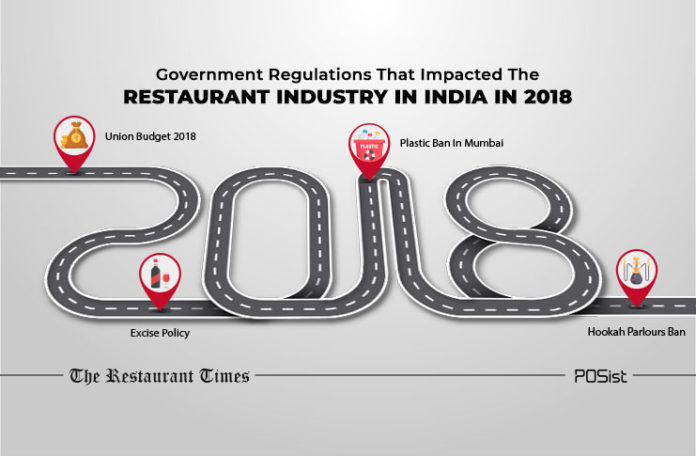

2018 had been a rollercoaster ride for the restaurant space; there have been a lot of changes levied on the industry. The year started on a gloomy mood as the restaurant space was hoping for some positive changes in the budget for the new fiscal year; however, all the hopes were dampened as the Union Budget fell quite short on expectations. 2018 turned out to be an eventful one for the restaurant space, with several government regulations impacting the business.

How 2018 Treated The Restaurant Industry In 2018

There have been a number of regulatory and governmental changes that the restaurant industry faced in 2018. Let us rewind the entire year to find out their impact on the restaurant business, month on month.

February- Union Budget 2018 Falls Short On The Expectations Of The Food & Beverage Industry

The first month of 2018 was pretty slow for the restaurant industry, as businesses were reeling under the effect of withdrawal of Input Tax Credit. The industry was hoping for some positive changes from the Union Budget 2018. However, the Budget fell short on the expectations of the restaurant business.

Although no direct influence was seen in the F&B industry, the Union Budget 2018 brought some positive changes for the agricultural sector. These changes might expand the supply and the quality of the raw materials which would in a way have a positive impact on the F&B industry. But it was tough to postulate that all the hope with which the entire industry was waiting for the budget has been severely shortened.

February – Positive Impact Of GST On the Restaurant Industry

February 2018 saw a lot of people coming up with their reviews about the positive impact that GST had had on the restaurant space. More than 70 percent of the restaurant owners in Bangalore and Mumbai saw GST as a conclusive decision for the industry, while 68 percent of the businesses felt it would ease compliance since it is backed by technology. Comparisons were also drawn between the GST and the Demonetization, which also had a compelling brunt on the restaurant business. Bengaluru felt the impact of demonetization more as compared to Mumbai.

March- Annual Liquor License Fee Remains the Same In Gurgaon

The new Excise policy that was announced in March created a sense of comfort for restaurants and bars owners in Gurgaon, as it remained the same and no changes were implemented in the fee. It allowed all formulations, including stand-alone pubs and bars, to apply for the liquor license. Earlier, only those places that had a three-star rating or more could apply for a liquor license.

However, the Excise License fee was hiked by 10% in Maharashtra.

April- Restro-bars Left High and Dry Owing to the Excise Policy

Last April, the Supreme Court’s ban on the purchase of alcohol near highways had blown restaurants, hotels, and bar owners. Although later it was modified and spared places that served liquor, restaurateurs said that their businesses were hit by the new excise policy and license norms.

Issues with excise department websites and online processing of outlet registrations led to bars and restaurants running out of liquor in some states.

May- Delhi’s Restaurateurs Bewildered Over Ban On Recorded Music In Pubs

On May 16, 2018, the Delhi government cautioned pubs not to play recorded music. It stated that restaurants and bars would only be approved to have live music or playing of musical instruments by experts. The circular was only issued for L-17 license holders or independent restaurants which had a license to serve liquor and exempted restaurants and clubs in hotels. As per industry estimates, Delhi has around 800-850 L-17 license holders, and the ban on recorded music affected a significant number of restaurants and bar.

“Playing of recorded music is a violation of the licensing rules. While permits were issued to these restaurants, it was clearly mentioned, as per the 2010 rules, that they will only be allowed to play live music,” said Amjad Tak, Excise Commissioner of Delhi.

June- Plastic Ban In Mumbai Blows the Restaurant Space

In June, the Maharashtra government imposed a ban on plastic. The move severely impacted the restaurant business since it directly hit the takeaway service. More than half of the restaurants’ income is from takeaways, but as plastic containers and even plastic packets were banned, food deliveries became very difficult. Within the restaurant space, the most severe impact was on the smaller chains like QSRs and dhabas, as small chains cannot shelter the cost of different alternatives. QSRs, on the other hand, strived hard on takeaways and with that medium shut, were in for more significant losses regarding opportunity cost.

July – FSSAI Launches ‘Eat Right Movement’

As a part of the ‘Eat Right’ initiative, in July 2018, the FSSAI ordered online food aggregators to delete all the unlicensed and unregistered restaurants from their websites by 30th September. The food aggregators were also instructed by the FSSAI to directly send them the list of defaulters so they could take the necessary actions. The FSSAI’s Eat Right Movement was even applied to the street food vendors. Health and hygiene standards of the food sold by street food vendors had always been a major concern. To solve this problem, FSSAI identified one hundred and forty-four street food clutch that was controlled with the help of state authorities and the ones found obeying the hygiene rules were provided with a “Clean Street Food Hub” certificate.

September- Zomato, Swiggy Delisted Restaurants

Following the ‘Eat Right Movement’, food delivery aggregators such as Zomato and Swiggy delisted restaurants that did not have a license from the food regulator from their platforms to adhere with a decree to this effect from Food Safety and Standards Authority of India (FSSAI) in September. Swiggy began the delisting process for restaurants since the FSSAI notice was first sent in July. “We have set up an FSSAI Assist Program to help all non-compliant restaurants procure their licenses within the specified timeframe,” said a spokesperson at Swiggy.

October- Hookah Parlors Banned In Maharashtra

The Maharashtra government had brought into effect a judicial amendment to cigarettes and other Tobacco Products (Prohibition) Act (COTPA) of 2003 to ban hookah parlors. The modification prevents any person from opening and owning a hookah parlor at any place in the state. However, the owners went against the government resolution prohibiting them from peacefully functioning and running parlors. Senior counsel Anil Anturka was seen arguing for the petitioners, told the court that the government had not banned tobacco but its consumption through a hookah. Anturkar submitted that the reason for the ban is the “Kamla Mills incident.” Anil Anturkar, appearing for the owners, said the State has the power to regulate but not prohibit.

November – Service Charge To Be Taxed As Income If Not Passed Along To Employees

The restaurant industry has always been at loggerheads with the government regarding the Service Charge, ever since it was made voluntary for the customers. Restaurants had earlier argued that Service Charge is a benefit for the restaurant staff, and therefore should be mandatory. However, the government seems to feel that this benefit is not being passed along to the staff.

In November, the Income Tax department asked its officers to verify as part of their regular assessments of restaurants and hotels if there is a total lack of disclosure of the Service Charge collected, and the details of its disbursal to the employees.

November – Only Standing Rooms For Smoking In Karnataka

The government of Karnataka directed bars, pubs, restaurants, and hotels to have only standing rooms for smoking. Chairs, tables, ashtrays, matchboxes, and lighters should not be allowed, said a circular issued by the Directorate of Municipal Administration. Also, non-smokers and under-18 should not be allowed to enter these areas. This move was an attempt to protect non-smokers from the dangers of secondhand smoke. Also, the fire department raised a concern about fire safety in the eating outlets in a letter which states open fire sources like smoking are potential causes for fire hazards, stated the circular. The newly formed coalition government in the state affirms that the rule will be strictly implemented in Karnataka. Smoking rooms a mandatory in pubs, restaurants, says the Karnataka government.

Restaurant Industry Highlights Of 2018

The restaurant industry faced several upheavals in the year 2018, resulting in positive as well as negative effect on the business. Let us hope that 2019 brings some great news for the restaurant space.