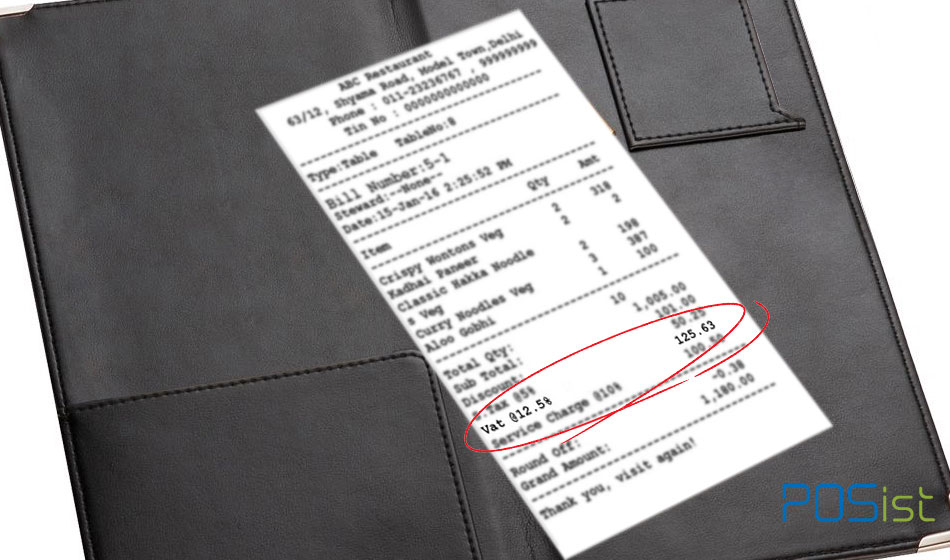

Good news for all the food lovers in Delhi. The Delhi government has proposed to reduce the VAT on snacks, sweets, and other food items. Now people eating in Delhi will have to pay only 5% VAT on their restaurant and food bills. Earlier under the tax regime, restaurants, and food outlets used to charge 12.5% on the total bill other than service tax and service charge. The reduction in VAT will boost the restaurant industry and will help in increasing the frequency of people eating out and their restaurant visits. Also, it will motivate small players and single outlet owners to charge VAT and maintain their customers who were earlier shying away to charge VAT so as to lower the bills for the customers and maintain the restaurant sales.

Restaurateurs Rejoice as Government Proposes to Reduce the VAT

A young entrepreneur operating an Ice cream parlour and bakery in East Delhi told Restaurant Times that “I was not able to charge VAT on my outlet bills as my target customers are middle-class. So, I use to pay VAT from my pocket but it was a huge dent in my margins. But, with this new regime, I would be able to charge VAT and maintain my margins at the same time with peace.”

On another hand, owner of fine- dining restaurant told us that, “It would be a relief to customers now. We have often observed customers do not want a bill and want discount instead of paying the VAT. The new regime has now put us and customers in a comfort zone. Experts in the industry believe that it’s a ‘win-win situation’ for all customers, restaurant owners, and the government. People will not evade VAT as they used to, which will overall increase the VAT collection of the government.

Find out how to get the VAT registration of your restaurant here.

if it is true( which i have huge doubt upon) this step will be a boon for the industry and also would increase the tax amount collected by the government.

The reduction is there in the budget. Will cut the exorbitant restaurant bills now!

Good news to the appetizers